tesla bcg matrix ,bcg matrix real life examples,tesla bcg matrix, The BCG Growth-Share Matrix is a tool used to categorize a company’s products based on their market share and the market growth rate. By visualizing products in four different quadrants, companies can make informed . STANDARD 100 by OEKO-TEX requires every component of a textiles product—including all thread, buttons, and trims—to be tested against a list of more than 1,000 harmful regulated and unregulated chemicals which may be harmful to human health.

Introduction

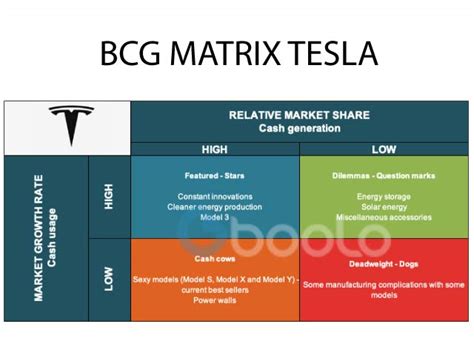

The Boston Consulting Group (BCG) Matrix is a business tool used to analyze the relative market position and potential of a company's product portfolio. Developed in the 1970s by the Boston Consulting Group, this matrix classifies a company’s products into four distinct categories based on their market growth rate and relative market share. These categories are Stars, Cash Cows, Question Marks, and Dogs. This analysis helps companies decide where to allocate resources, which products to invest in, and which ones to divest.

In this article, we will delve into the BCG Matrix as it applies to Tesla Inc., a company that has revolutionized the electric vehicle (EV) industry and expanded its efforts into the sustainable energy sector. Tesla’s consistent innovation, aggressive expansion strategy, and strong leadership in electric vehicles have positioned it as a dominant player in the market. By analyzing Tesla’s product offerings through the lens of the BCG Matrix, we can gain valuable insights into how the company maintains its competitive edge and adapts to changing market dynamics.

Understanding the BCG Matrix

Before we analyze Tesla’s position within the BCG Matrix, let’s first review the four quadrants:

1. Stars: These are products with high market share in a fast-growing industry. They often require heavy investment to maintain their dominant position but generate significant revenue and profits. Over time, they have the potential to become Cash Cows.

2. Cash Cows: Products in this category have a high market share but are in a low-growth industry. They generate steady cash flow and are highly profitable with minimal investment. These products help fund other areas of the business, including Stars or Question Marks.

3. Question Marks: These are products in a high-growth industry but have a low market share. They require significant investment to increase their market share and profitability. Depending on the company’s strategy, Question Marks can either turn into Stars or be phased out if they don’t perform.

4. Dogs: Products that have a low market share in a low-growth industry. These products typically generate low or negative returns and may drain resources from the company. Companies often consider divesting or discontinuing these products.

Now, let’s apply this framework to Tesla, a company that has seen dramatic growth in recent years while pushing the boundaries of innovation in electric vehicles, energy storage solutions, and solar power.

Tesla’s BCG Matrix Analysis

1. Stars: Electric Vehicles (EVs)

Tesla's electric vehicles (EVs) are undoubtedly the company’s Star products. These vehicles have revolutionized the automotive industry and have propelled Tesla to the forefront of the EV movement. Tesla is not only leading in sales but is also defining the future of electric mobility with its state-of-the-art technology, long battery life, and high performance.

# Model S, Model 3, Model X, and Model Y

Tesla's core EV lineup, which includes the Model S, Model 3, Model X, and Model Y, all fall into the Star category. Each of these vehicles serves different market segments:

- Model S: A luxury sedan that has become synonymous with high-performance electric cars. Its range, acceleration, and overall design make it one of the most coveted electric vehicles on the market.

- Model 3: A more affordable electric sedan aimed at mass-market consumers. It has been Tesla’s best-selling model and has played a key role in popularizing electric vehicles worldwide.

- Model X: Tesla's electric SUV, known for its distinctive falcon-wing doors and impressive safety features.

- Model Y: A compact electric SUV that has quickly gained popularity and is expected to be one of Tesla's top sellers in the coming years.

These vehicles have contributed significantly to Tesla’s revenue growth and market presence, especially as global demand for electric vehicles increases. Tesla’s market share in the global EV market continues to rise, with the company holding a commanding position in several regions, including the U.S., Europe, and China. Tesla’s R&D in autonomous driving, battery technology, and software updates gives its vehicles a significant edge over competitors.

Innovation and Sustainability: The innovative aspects of Tesla’s EVs, such as Autopilot (Tesla's semi-autonomous driving system), Full Self-Driving (FSD) capability, and the extensive Supercharger network, further strengthen their position as Stars. Moreover, Tesla’s commitment to sustainability, particularly through the reduction of carbon emissions and its focus on cleaner energy, adds a competitive advantage.

tesla bcg matrix Jama has been chosen as the face of Dolce & Gabbana, and she wows with a fresh new take on bombshell in a new campaign video for the brand. Looking barely recognizable, Jama rocks short, bouncy.

tesla bcg matrix - bcg matrix real life examples